ELSS Mutual Fund

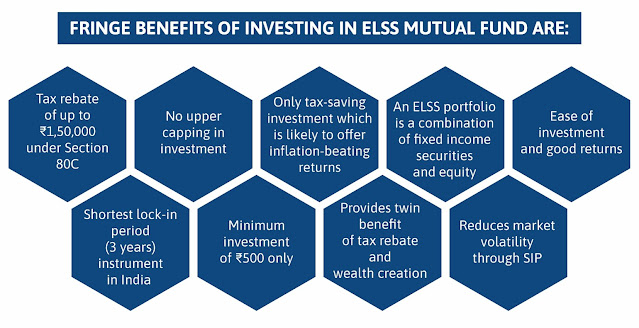

ELSS MUTUAL FUND The ELSS (Equity-Linked Savings Scheme) of Mutual Funds is one of the best methods to generate wealth combined with tax benefits with the shortest lock-in period in India. The ELSS mutual fund is a tax-saving tool that enables you to save up to Rs. 46,800 annually and claim a tax credit of Rs. 1,50,000 each year under Section 80C of the Income Tax Act, 1961. SAVE TAX + BUILD WEALTH = ELSS Mode of investment in ELSS: SIP (Systematic Investment Plan) or Lumpsum? With a SIP, you can continue to contribute a little amount at regular intervals with the choice of investing weekly, monthly, quarterly, or biannually. SIP enables you to buy more units when the market is down and fewer units when the market is up, making it easier to profit from purchasing fund units during market cycles. When the market rises, SIP offers more financial gains upon redemption than the Lumpsum style of investment. Thus, investing in a lump sum is not advised to lower risk. Why recommend inves...